Today, we publish our first full sectoral analysis of the UK’s digital identity ecosystem.

The aim of the report – which was produced by an independent research consortium – is to establish a baseline of measures of the digital identity sector so that we can capture trends, tracking these on a regular basis to understand how the market is performing.

In this blog post, we’ll try to give a snapshot of a few of the key findings – but for full details, head over to GOV.UK to read the full report.

Consumer attitudes and use of digital identity products

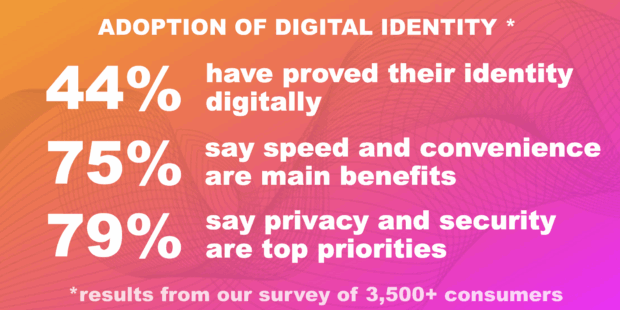

The most significant change to the interim report published last year is the inclusion of findings from an online and telephone survey of 3,561 consumers across the UK, including people from a range of backgrounds and levels of digital access and skill.

Through our survey questions, we wanted to explore peoples’ understanding of digital identity, usage of products, benefits derived, and barriers to adoption.

Among the key findings were that that:

- Almost half (44%) of respondents had used a digital identity service at some point in their lives. Most of these involved one-off identity checks – only a minority (20%) of those who had used any digital identity service said that they’d presented a reusable digital identity. In general, understanding of digital identity was high, with more than 70% of all respondents saying they had at least some understanding of what a digital identity was.

- Digital identity services are helping people meet a broad spectrum of common needs, from accessing online games (38% of those using any digital verification service), to applying for a credit card or loan (36%), opening a bank account (27%), performing a DBS check (26%), proving right to work (21%) and renting a property (18%).

- Timesaving and convenience are top of the list of benefits, with 75% of users saying these were advantages of digital identities compared to physical IDs.

- Privacy and security are of paramount importance to users, with 79% of people saying these were their top considerations when deciding to use a digital identity service. Around 8% said they actively chose not to use a digital identity service specifically due to privacy or security concerns.

The report also includes new analysis of understanding, attitudes and adoption of digital identity based on different demographics (age, ethnicity, household income), varying forms of existing ID, and levels of digital access and skill.

And it highlights the important role of government, with 75% of respondents saying it was important to them that a service was tested against government standards.

A £2.1 billion UK digital identity provider market

The full report updates core figures on UK digital identity sector size and scale, with findings including:

- £2.1 billion sector revenue (2023/24), with £888 million Gross Value Added (GVA)

- 266 firms based across the UK, with 10,246 full-time equivalent (FTE) employees. Three-quarters of firms are headquartered in the UK.

- Sector employment has grown an average of 11.7% per annum since 2020, and GVA per employee is £86,600, which is 56% higher than average UK employee estimates

- Core use cases for products include onboarding (42% of providers), fraud prevention (37%), supporting Know Your Customer / Anti-Money Laundering (32%), and identity verification for account opening (20%).

The report takes a deeper dive than previously into the global perspective, finding that the UK sector is highly internationalised. For example, 1 in 4 firms based in the UK are headquartered internationally, suggesting the UK is an attractive place for Foreign Direct Investment (FDI). It also finds that:

- 34% of UK headquartered firms have a presence in international markets

- 57% of the revenue of the 20 largest firms is generated from international markets

Looking into the wider innovation and research & development ecosystem in the UK, the report finds that 1 in 20 firms (6%) have received publicly-funded investment for research. Innovative solutions produced by the sector are exported globally, for example to support social vouching.

A few initial reflections

We’ve found the results of this work fascinating, and there’s still much to chew through from our published report. But for us, a few key things are emerging from the findings:

- Are digital identities finally entering the mainstream? With almost half of those surveyed having used a digital identity service, and the vast majority benefitting from increased speed and convenience, are we reaching the much-discussed ‘tipping point’ at which digital identity products are becoming ubiquitous? Like contactless payments or self-service checkouts, what was only recently a novel invention may be swiftly becoming the norm.

- Ensuring high standards of privacy and security remains fundamental to our mission. An overwhelming majority of people (79%) are looking for digital identities to be secure and privacy-protecting, with 75% looking for government to play an active role in ensuring these standards are met. To some extent, that’s no surprise given our previous research. But it helps remind us that OfDIA’s mission to establish a trusted, secure market for digital identity in the UK is as relevant and vital as ever.

- The UK digital identity sector is operating on a global scale. The report reveals that the UK’s digital identity sector has more than £2 billion revenue. High productivity. High export volumes. More than 10,000 FTE employees. Employment growing 12% year on year. It’s a sector that seems poised for further success, in the UK and globally.

- Access and inclusion remain areas of particular focus. The data shows that some people (9%) just prefer to use non-digital methods – and that’s fine with us, our goal is always for people to have a choice. The report does however suggest varying levels of digital identity use according to demographic, which we will reflect on further in the context of our ongoing inclusion monitoring work.

- Moving to reusable digital identities. Single use checks remain dominant, but we know they’re normally less financially and time efficient for people and businesses. There is a long way to go in uplifting adoption of reusable products from the current 20%.

Towards the next report

Producing this report has been no small task, and we’re really grateful to our consortium of providers – Oliver Wyman, Perspective Economics and Projects by If – for providing expert insight and challenge through the process. We’re also grateful to all the digital identity providers who commented on the methodology and approach.

We’ll be repeating this research on an annual basis, to help us track market trends and consumer attitudes – in part, helping to inform the annual report that OfDIA will produce as required by the Data Bill. We’ll be coming back out to stakeholders in due course to help guide priorities for future research, based on this year’s findings.

Sign up to email alerts to receive an update whenever we publish a new blog post.